Best Stocks in FMCG Sector

1) Hindustan Unilever Ltd.

About HUL:

Hindustan Unilever Ltd., incorporated in the year 1933, is a Large Cap company (having a market cap of Rs 538,514.57 Crore) operating in FMCG sector. Hindustan Unilever Ltd. key Products/Revenue Segments include Personal Care and Other Operating Revenue for the year ending 31-Mar-2021.For the quarter ended 31-03-2022, the company has reported a Consolidated Total Income of Rs 13,846.00 Crore, up 2.57 % from last quarter Total Income of Rs 13,499.00 Crore and up 10.40 % from last year same quarter Total Income of Rs 12,542.00 Crore. Company has reported net profit after tax of Rs 2,307.00 Crore in latest quarter.

HUL Chart (1 day)

2) Nestle India Ltd.

About Nestle India Ltd.:

Nestle India Ltd., incorporated in the year 1959, is a Large Cap company (having a market cap of Rs 165,555.43 Crore) operating in FMCG sector. Nestle India Ltd. key Products/Revenue Segments include Milk Products, Prepared Dishes & Cooking aids, Confectionery, Beverages (Powdered), Export Incentives, Other Operating Revenue for the year ending 31-Dec-2021.For the quarter ended 31-03-2022, the company has reported a Standalone Total Income of Rs 4,002.14 Crore, up 6.25 % from last quarter Total Income of Rs 3,766.65 Crore and up 9.93 % from last year same quarter Total Income of Rs 3,640.47 Crore. Company has reported net profit after tax of Rs 594.71 Crore in latest quarter.

|

| Nestle India Chart (1 day) |

3) ITC Ltd.

About ITC Ltd.:

ITC Ltd., incorporated in the year 1910, is a Large Cap company (having a market cap of Rs 336,055.19 Crore) operating in Tobacco sector. ITC Ltd. key Products/Revenue Segments include Packaged Food Item, Agricultural Products, Paper & Paper Boards, Others, Tobacco Unmanufactured, Service (Hotel), Printed Materials, Other Operating Revenue for the year ending 31-Mar-2021.For the quarter ended 31-03-2022, the company has reported a Consolidated Total Income of Rs 18,252.64 Crore, down 2.85 % from last quarter Total Income of Rs 18,787.72 Crore and up 22.32 % from last year same quarter Total Income of Rs 14,921.76 Crore. Company has reported net profit after tax of Rs 4,259.68 Crore in latest quarter.

|

| ITC Chart (1 day) |

4) Britannia Industries Ltd.

About Britannia Industries Ltd:

Britannia Industries Ltd., incorporated in the year 1918, is a Large Cap company (having a market cap of Rs 85,026.51 Crore) operating in FMCG sector. Britannia Industries Ltd. key Products/Revenue Segments include Food Products, Other Operating Revenue, Scrap, Royalty Income, Other Services for the year ending 31-Mar-2021.For the quarter ended 31-03-2022, the company has reported a Consolidated Total Income of Rs 3,604.28 Crore, down .71 % from last quarter Total Income of Rs 3,630.11 Crore and up 12.85 % from last year same quarter Total Income of Rs 3,193.94 Crore. Company has reported net profit after tax of Rs 377.87 Crore in latest quarter.

|

| Britannia Chart (1 day) |

5) Dabur India Ltd.

About Dabur India Ltd:

Dabur India Ltd., incorporated in the year 1975, is a Large Cap company (having a market cap of Rs 90,858.98 Crore) operating in FMCG sector. Dabur India Ltd. key Products/Revenue Segments include Personal Care, Other Operating Revenue and Scrap for the year ending 31-Mar-2021.For the quarter ended 31-03-2022, the company has reported a Consolidated Total Income of Rs 2,616.95 Crore, down 13.87 % from last quarter Total Income of Rs 3,038.49 Crore and up 8.06 % from last year same quarter Total Income of Rs 2,421.77 Crore. Company has reported net profit after tax of Rs 295.54 Crore in latest quarter.

6) Godrej Consumer Products Ltd.

About Godrej Consumer Products Ltd:

Godrej Consumer Products Ltd., incorporated in the year 2000, is a Large Cap company (having a market cap of Rs 78,058.73 Crore) operating in FMCG sector. Godrej Consumer Products Ltd. key Products/Revenue Segments include Home Care, Personal Care, Hair Care, Other Operating Revenue for the year ending 31-Mar-2021.For the quarter ended 31-03-2022, the company has reported a Consolidated Total Income of Rs 2,939.58 Crore, down 11.59 % from last quarter Total Income of Rs 3,324.99 Crore and up 7.00 % from last year same quarter Total Income of Rs 2,747.31 Crore. Company has reported net profit after tax of Rs 363.23 Crore in latest quarter.

.PNG) |

| Godrej Consumer Products Chart (1 day) |

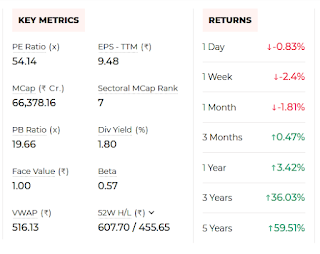

7) Marico Ltd.

About Marico Ltd:

Marico Ltd., incorporated in the year 1988, is a Large Cap company (having a market cap of Rs 66,378.16 Crore) operating in FMCG sector. Marico Ltd. key Products/Revenue Segments include Edible Oil, Others, Personal Care, Export Incentives, Scrap for the year ending 31-Mar-2021.For the quarter ended 31-03-2022, the company has reported a Consolidated Total Income of Rs 2,185.00 Crore, down 10.05 % from last quarter Total Income of Rs 2,429.00 Crore and up 7.06 % from last year same quarter Total Income of Rs 2,041.00 Crore. Company has reported net profit after tax of Rs 257.00 Crore in latest quarter..PNG) |

| Marico Chart (1 day) |

8) Colgate Palmolive (India) Ltd.

About Colgate Palmolive (India) Ltd:

Colgate-Palmolive (India) Ltd., incorporated in the year 1937, is a Large Cap company (having a market cap of Rs 42,505.91 Crore) operating in FMCG sector. Colgate-Palmolive (India) Ltd. key Products/Revenue Segments include Personal Care, Service Income and Scrap for the year ending 31-Mar-2021.For the quarter ended 31-03-2022, the company has reported a Standalone Total Income of Rs 1,310.13 Crore, up 1.89 % from last quarter Total Income of Rs 1,285.80 Crore and up 1.58 % from last year same quarter Total Income of Rs 1,289.81 Crore. Company has reported net profit after tax of Rs 323.57 Crore in latest quarter.9) Procter & Gamble Hygiene & Healthcare Ltd. (P&G)

About P&G:

Procter & Gamble Hygiene & Healthcare Ltd., incorporated in the year 1964, is a Large Cap company (having a market cap of Rs 45,444.87 Crore) operating in FMCG sector. Procter & Gamble Hygiene & Healthcare Ltd. key Products/Revenue Segments include Hygiene Products, Creams & Ointments, Cough Drops, Tablets for the year ending 30-Jun-2021.For the quarter ended 31-03-2022, the company has reported a Standalone Total Income of Rs 979.29 Crore, down 10.96 % from last quarter Total Income of Rs 1,099.84 Crore and up 26.46 % from last year same quarter Total Income of Rs 774.41 Crore. Company has reported net profit after tax of Rs 102.85 Crore in latest quarter..PNG) |

| P & G Chart (1 day) |

10) Gillette India Ltd.

About Gillette India Ltd:

Gillette India Ltd., incorporated in the year 1984, is a Large Cap company (having a market cap of Rs 15,955.35 Crore) operating in FMCG sector. Gillette India Ltd. key Products/Revenue Segments include Personal Care for the year ending 30-Jun-2021.For the quarter ended 31-03-2022, the company has reported a Standalone Total Income of Rs 567.82 Crore, up .47 % from last quarter Total Income of Rs 565.15 Crore and up 1.83 % from last year same quarter Total Income of Rs 557.64 Crore. Company has reported net profit after tax of Rs 69.31 Crore in latest quarter..PNG) |

| Gillette Chart (1 day) |

About The Post

Through this article, I shared with you some information about Best Stocks in FMCG Sector If you like this article then share with your friends so that they can plan trading or long term investment from today. Apart from this if you have any problem or suggestion or feedback, then email me. I will try to help you.

Source: ETmarkets, Samco.in, Kite

.PNG)

Please do not enter any spam link in the comment box.